We're here to help 24/7. If you've been affected by bushfire or flood, you can make an insurance claim online, in the RACV App or call us on 13 19 03.

Award-winning car insurance for Victorians

Trusted on the road since 1903. Explore cover to protect your own car or third parties from loss or damage.

Exceptional quality, with great benefits

Complete Care®: 2025 winner of Mozo Exceptional Quality Car Insurance.+

2025 winner of WeMoney’s Best for Member Benefits Car Insurance.

2025 winner of several Finder Customer Satisfaction Awards for Victoria.†

Compare options to protect your car

Tailor your car insurance quote with flexible cover. This is a summary only. For a full list of inclusions, conditions, limits and exclusions, read the Product Disclosure Statement.

Looking for more specialised cover?

Enjoy more discounts with RACV

With living costs on the rise, we’re here to help you insure what matters most while protecting your wallet.

Frequently asked questions

With RACV Insurance, you can insure your car for the market value or agreed value, depending on your policy.

Market value

This is an assessment of your vehicle’s value at the time of an incident you’re making a claim for. It considers local market prices and the age and condition of your vehicle. You’ll get market value with these policies:

- Comprehensive (choice of market or agreed value)

- Third Party Fire and Theft

- Third Party Property Damage

Agreed value

This is how much RACV Insurance agrees to insure your vehicle for during the term of your policy. You can choose from within a value range. You’ll get agreed value with these policies:

- Complete Care®

- Comprehensive (choice of agreed or market value)

Renewing your policy

RACV Insurance considers the changes in your vehicles agreed value using local market values. Check your renewal notice for any changes.

For more information on what’s included in your agreed or market value, check the Product Disclosure Statement.

Did this answer your question?

Thank you for your feedback

Thank you for your feedback

There are lots of ways we can help you take control of your insurance policy and premium.

For example, when buying or renewing your RACV Car Insurance, you can:

- explore flexible basic excess

- update your cover to market or agreed value

- review your optional extras

- check listed drivers and remove any additional drivers you don’t need.

Learn more about what impacts premium prices, and what you can do to help reduce your premium – including a range of benefits and discounts available to RACV Members.

Did this answer your question?

Thank you for your feedback

Thank you for your feedback

You can make a claim 24/7 in the app, online or by phone. No matter who is at fault in an incident, the process of making a claim is the same.

What you need to prepare your claim

Provide us with information on the incident, like recorded time, witness’ contacts and details of other drivers involved (if applicable).

Include photos of the incident to help with your claim.

If your car has been stolen in Victoria, contact the Police Assistance Line on 131 444, before making an insurance claim. We may ask you for a police report reference number and the date reported.

For more advice, read our claims guide.

Did this answer your question?

Thank you for your feedback

Thank you for your feedback

A car insurance excess is the amount you contribute toward the cost of a claim once it has been accepted. There are three types of excess: basic, age and inexperienced driver.

Some situations where you'll need to pay an excess:

- you or the person driving your vehicle was at fault in an incident

- the incident wasn't your fault but you don't have the details of the at-fault party

- the damage is caused by collision with an animal

- your car was damaged by an event (such as hail, or a tree during a storm).

When you start a claim online, you'll find out whether an excess is payable. If you have an excess to pay, you can log in to pay it online.

For more detailed information, see the Premium, Excesses and Discounts Guide (PED).

Did this answer your question?

Thank you for your feedback

Thank you for your feedback

No matter who’s driving, RACV Motor Insurance covers all licensed drivers provided they meet policy conditions and have your permission to drive your vehicle.^

You don’t need to list all additional drivers using your vehicle, but it’s worth considering based on how frequently others drive it and any additional excesses that may apply to unlisted drivers.

Your car insurance premium may change if another driver is listed on your policy.

If an unlisted driver is found at fault for an incident while driving your vehicle, you may have to pay an additional excess on top of your basic excess.

For further details on excess charges based on your policy, read the Premium, Excesses and Discounts Guide (PED).

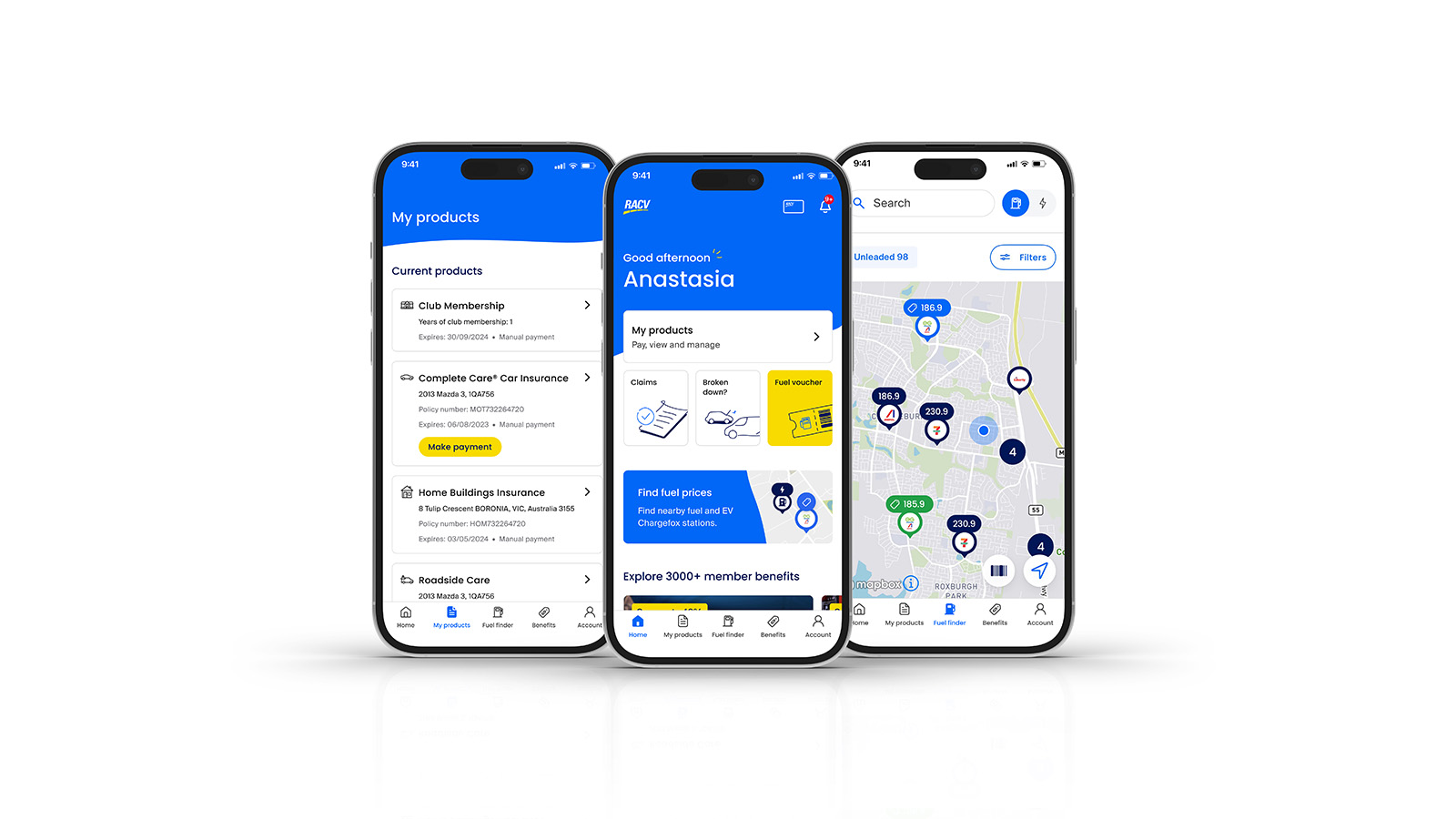

Add drivers to your policy in the RACV App

- Download the RACV App

- Tap on ‘my products’

- Tap on your policy and then ‘view and manage policy’

- Under ‘Manage your policy’ tap ‘add, remove or edit drivers’

- Tap ‘edit’ and update driver details.

Add drivers to your policy in your online account

- Log in to your online account

- Click on your policy

- Scroll to ‘the drivers’ section

- Click ‘edit’ and update driver details.

Did this answer your question?

Thank you for your feedback

Thank you for your feedback

You can choose your own repairer with Complete Care® Car Insurance, or you can add this option to Comprehensive Car Insurance policies. It’s not available with Third Party Car Insurance policies.

If you choose to arrange your own repairer, make sure you have selected an authorised repairer who meets industry standards. If anything goes wrong (like faulty work), it won’t be covered in your policy.

Using RACV’s Repair Network

Your RACV Car Insurance includes access to more than 90 high-quality partner repairers.

These businesses quote, assess and provide quality repairs for your car. Plus you’ll get a lifetime guarantee on workmanship of any repairs authorised by RACV Insurance, as long as you’re the owner of the vehicle.

Did this answer your question?

Thank you for your feedback

Thank you for your feedback

^ Provided they meet policy conditions and have your permission to drive your vehicle. Additional excess applies to drivers under 25 or with less than 2 years' driving experience.

+ RACV Complete Care® Car Insurance recognised in Mozo Experts Choice Awards 2025 - more information on the awards research methodology at https://mozo.com.au.

† RACV Insurance recognised in the Finder Customer Satisfaction Awards – more information on the awards research methodology at https://www.finder.com.au/finder-awards.

~ If you purchased a new or demonstrator vehicle weighing less than 2.5 tonnes, RACV Insurance considers it a total loss, a similar replacement vehicle is available in Australia and any credit provider noted on your Certificate of Insurance agrees. Further conditions apply. See the Product Disclosure Statement for details.

* The Multi-Policy Discount and Years of Membership Benefits exclude Travel, Business and Farm Insurance products. To qualify for the Multi-Policy Discount, you must hold two eligible RACV Insurance policies. For further details, see the Premium, Excess and Discounts guide at racv.com.au. Discounts will only be applied until any applicable minimum premium is reached. On renewal, any increases or decreases in your premium may be limited by factors such as your previous year’s premium. You may not save more with more eligible policies and by staying with RACV Insurance longer if a minimum premium is reached, or limits have been applied to increases or decreases in your premium.

# RACV Years of Membership: at 5 years Bronze cardholders receive a 5% discount, at 10 years Silver cardholders receive a 10% discount, at 25 years Gold cardholders receive a 15% discount and at 51 years Gold 50 cardholders receive a 20% discount.

Terms and conditions apply to all offers. Click on the offer to find out more details.

The information provided is general advice only. Before making any decisions please consider your own circumstances and the Product Disclosure Statement and Target Market Determinations. For copies, visit racv.com.au. As distributor, RACV Insurance Services Pty Ltd AFS Licence No. 230039 receives commission for each policy sold or renewed. Product(s) issued by Insurance Manufacturers of Australia Pty Ltd ABN 93 004 208 084 AFS Licence No. 227678.